Depreciation interest calculator

The average car depreciation rate is 14. MACRS Depreciation Calculator Help.

Depreciation Formula Examples With Excel Template

To compute compound interest we need to follow the below steps.

. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. Years at a given interest. As we have done previously if we want to calculate interest earned we simply subtract out the raw amounts that we added each period which in total equates to 135 12 1620.

This rule states that the depreciation recapture on real estate property is not taxed as ordinary income as long as a straight line depreciation was used over the life of the property. Let us take another example to understand the difference between simple interest and compound interest. 65 simple interest rate.

The lender has offered two options-60 interest to be compounded annually. Simple Interest Example Problems. The interest can be compounded annually semiannually quarterly monthly or daily.

Depreciation Calculator as per Companies Act 2013. See how much you can save in 5 10 15 25 etc. For the first year you simply pay each month this monthly interest rate multiplied by the total value of the loan.

If you have a question about the calculator and what it does or does not support feel free to ask it in the comment section on this page. To use the calculator simply enter the purchase price of the car and the age at which the car was when it was purchased by you 0 for brand new 1 for 1-year old etc. When you borrow money from a lender you are required to make repayments typically monthly to repay the money borrowedThis repayment includes the principal taxes insurances and the interestThe amount of interest that accumulates between payments is known as accrued interest.

Luckily we dont have to work too hard for this example. GST Input Reversal Interest Calculator. Compound Interest Explanation.

D P - A. The payments for the first twelve months will be calculated as follows. The depreciation formula is pretty basic but finding the correct depreciation rate d j is the difficult part because it depends on a number of factors governed.

My father loans me 2000 to buy a used car and tells me I need to pay it off in one big chunk a balloon. Try using the above calculator to solve the example problems listed below. Above is the best source of help for the tax code.

The interest rate per period will be 00512 since the payments are made monthly. Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase. TaxAdda Private Limited CIN - U93000RJ2019PTC067547 GSTIN - 08AAHCT6764E1Z1.

For instance a widget-making machine is said to depreciate when it produces fewer widgets one year compared to the year before it or a car is said to depreciate in value after a fender bender or the discovery of a faulty transmission. So part of the gain beyond the original cost basis would be taxed as a capital gain but the part that relates to depreciation is taxed at the 1250 rule rate. Find out the initial principal amount that is required to be invested.

Therefore interest accumulated is equal to 176056 - 1620 14056. A P 1 - R100 n. Accrued interest is part of the cost borrowing money.

The Car Depreciation Calculator uses the following formulae. Monty has decided to start a small hatchery for which is planning to borrow a sum of 5000 for 5 years. D j d j C.

Divide the Rate of interest by a number of compounding period if the product doesnt pay interest annually. TDS Late Payment Interest Calculator. GST Payment and Input Tax Credit Calculator.

If you leave the Depreciation period field empty the car depreciation calculator will output the depreciation over the next 8 years. Under the MACRS the depreciation for a specific year j D j can be calculated using the following formula where C is the depreciation basis cost and d j is the depreciation rate. TDS Return Due Date.

You have a savings account that earns Simple InterestUnlikelyMost savings accounts earn compound interest. Compounding frequency could be 1 for annual 2 for semi-annual 4 for quarterly and. Include additions contributions to the initial deposit or investment for a more detailed calculation.

A list of commonly used depreciation rates is given in a. Depreciation rates as per income tax act for the financial years 2019-20 2020-21 are given below. Estimate the total future value of an initial investment or principal of a bank deposit and a compound interest rate.

The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab. Follow the next steps to create a depreciation schedule. Using the MACRS Tables.

The MARCS depreciation calculator creates a depreciation schedule showing the depreciation percentage rate the depreciation expense for the year the accumulated depreciation the book value at the end of the year and the depreciation method used in calculating. Using the Car Depreciation calculator. Example of an Annuity Due.

What is Accrued Interest.

Depreciation Formula Calculate Depreciation Expense

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Depreciation Rate Formula Examples How To Calculate

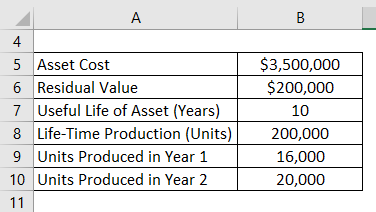

Units Of Activity Depreciation Calculator Double Entry Bookkeeping

Compound Interest And Reducing Balance Calculator Vce Geogebra

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

Declining Balance Depreciation Calculator

Depreciation Formula Examples With Excel Template

Car Depreciation Calculator Calculate Depreciation Of A Car Or Other Vehicle

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

Compound Interest Calculator For Excel

Macrs Depreciation Calculator With Formula Nerd Counter

Free Macrs Depreciation Calculator For Excel

Car Depreciation Calculator

Depreciation Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template

Annual Depreciation Of A New Car Find The Future Value Youtube